- Manual or volume-insensitive execution causes slippage and inefficiencies.

- Limited adoption of algorithmic execution across Turkish markets.

- Low visibility into actual trading costs.

- Reliance on single-broker routing paths.

- Platforms

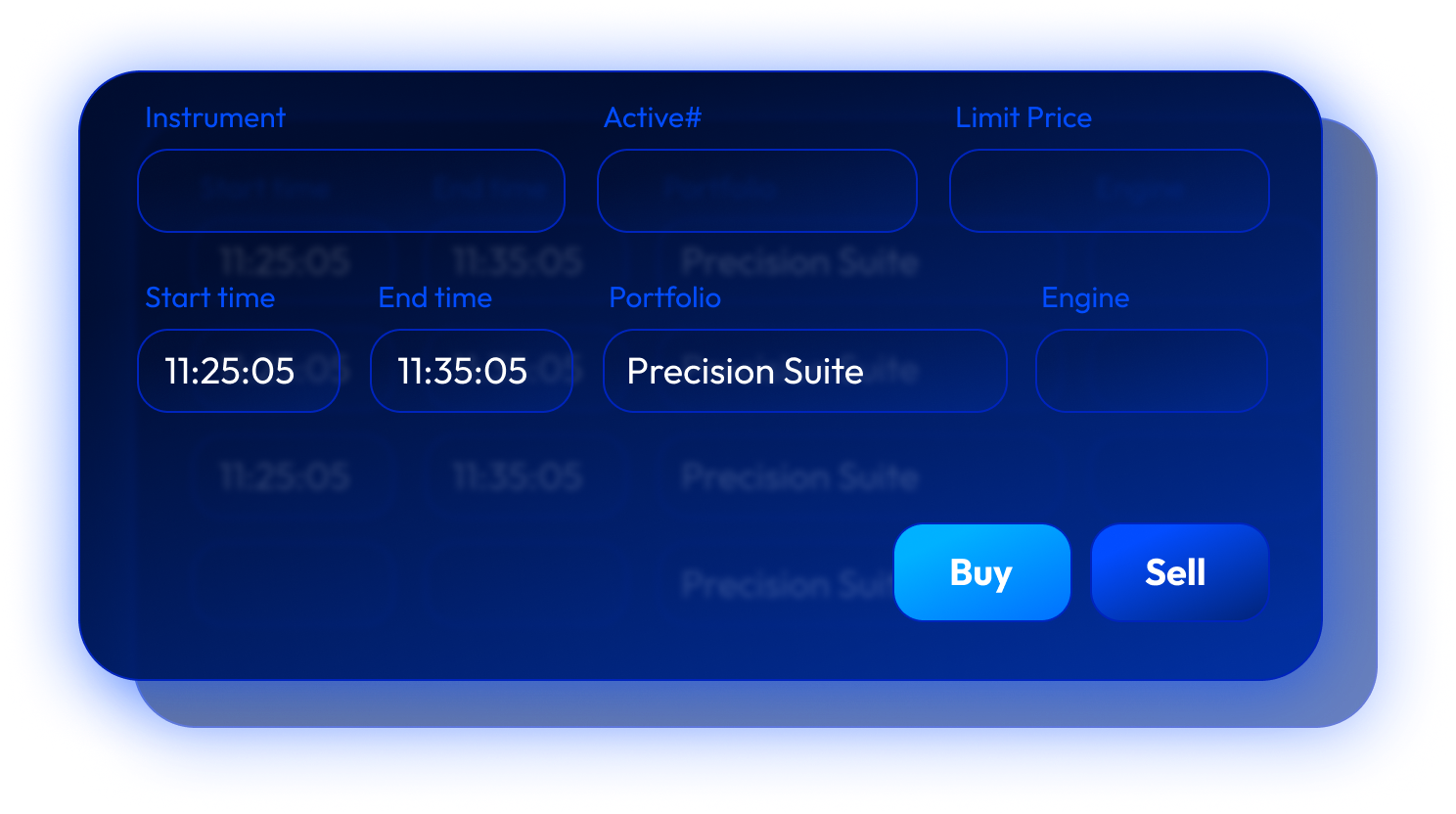

Systematic Asset Management & Tokenization Platform

Institutional Scale Meets Digital Freedom - Market Making

- About Us

- Careers

- Contact