- Static algorithm selection limits adaptability.

- Traders lack data to optimize algo choice.

- Manual switching creates inconsistency and bias.

- No unified feedback system between algos and outcomes.

- Platforms

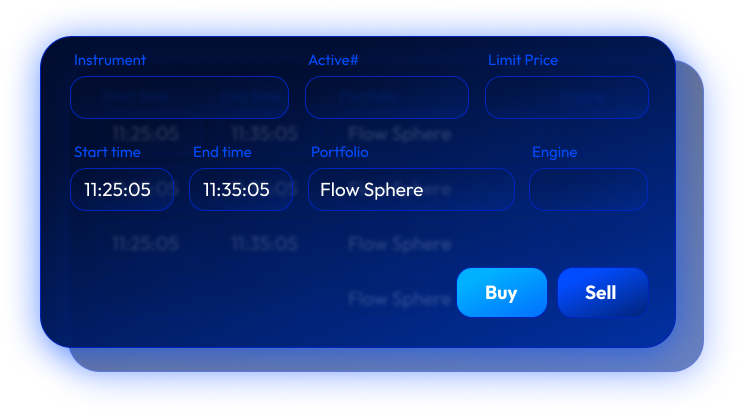

Systematic Asset Management & Tokenization Platform

Institutional Scale Meets Digital Freedom - Market Making

- About Us

- Careers

- Contact