Comprehensive Cash & Liquidity Management

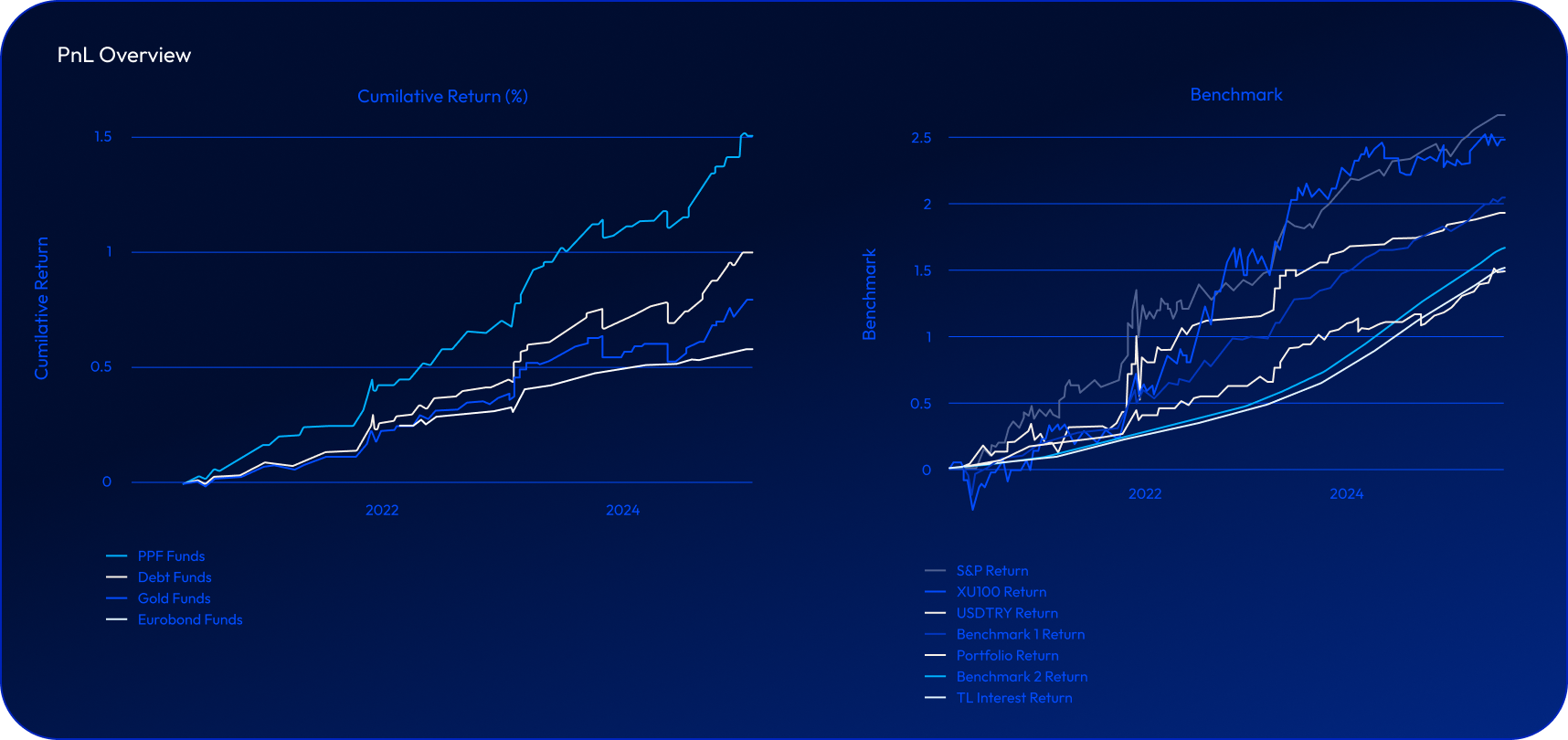

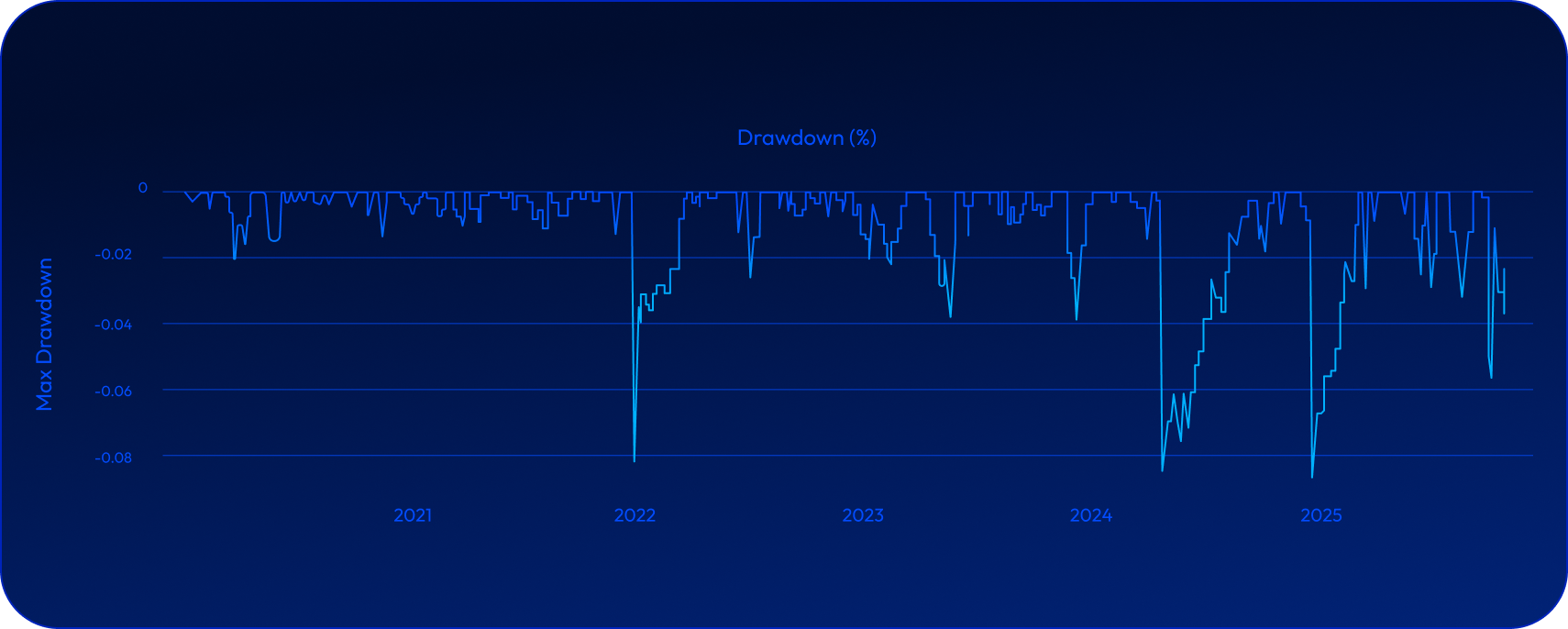

Algocor’s Treasury Solution provides a professional framework for institutional portfolio setup — combining allocation tools, risk dashboards, and scenario simulations into a single environment.

It streamlines cash, liquidity, and fund management operations across asset classes, ensuring measurable alignment between capital use and performance targets.

Key Capabilities

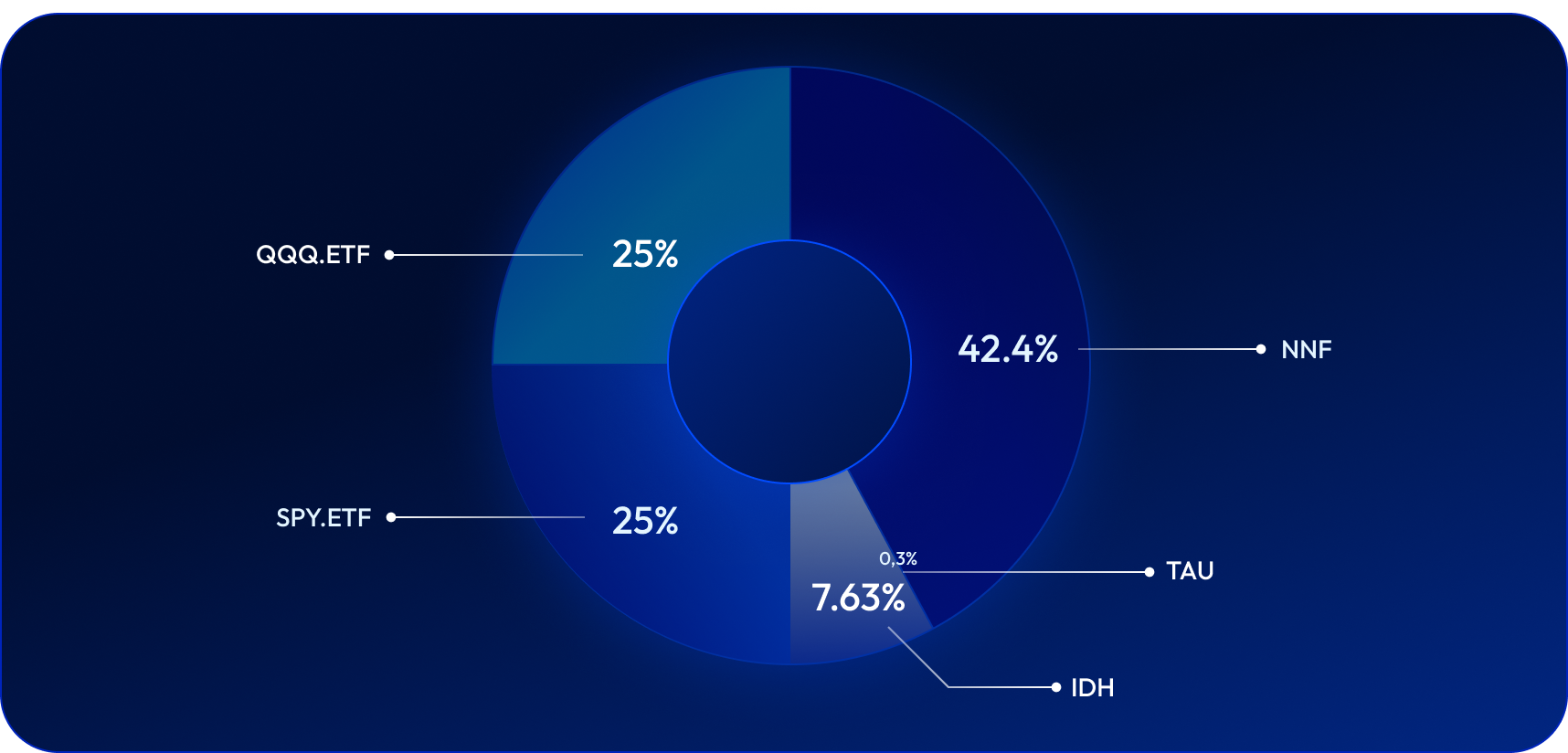

- Multi-asset coverage (mutual funds, ETFs, hedge funds).

- Dynamic walk-forward optimization to adapt allocations in changing markets.

- Stress testing and sensitivity analysis for macro events.

- TEFAS & Borsa Istanbul data integration for transparency and auditability.