- Fragmented interfaces between trading, risk, and analytics systems.

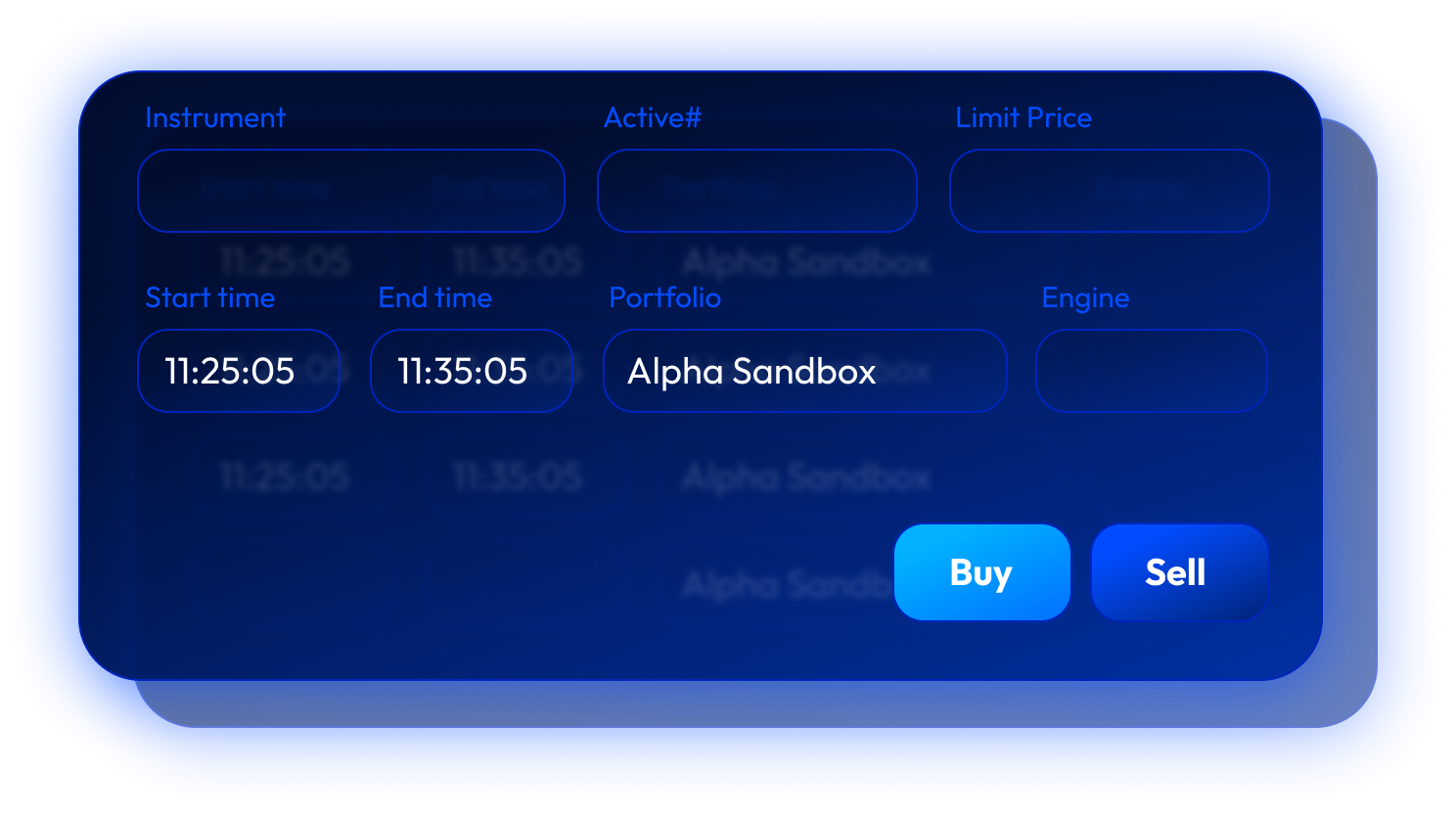

- Closed architectures that limit strategy automation.

- Lack of cross-venue order and data standardization.

- Slow, manual integration with external systems.

- Platforms

Systematic Asset Management & Tokenization Platform

Institutional Scale Meets Digital Freedom - Market Making

- About Us

- Careers

- Contact