- High operational friction in converting strategies into investable notes.

- Manual compliance and lifecycle management.

- Limited transparency into underlying performance and NAV.

- Long launch timelines and reliance on third-party wrappers.

- Platforms

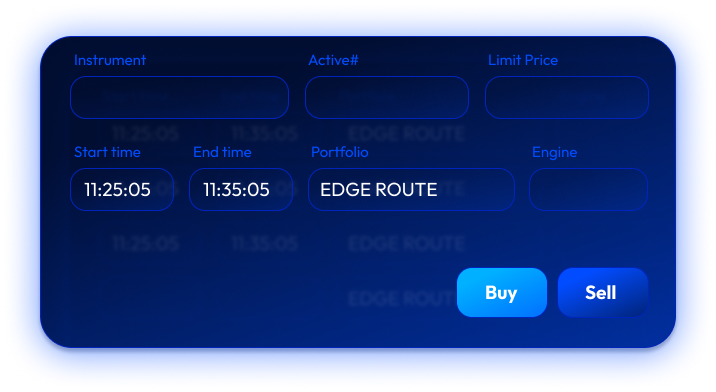

Systematic Asset Management & Tokenization Platform

Institutional Scale Meets Digital Freedom - Market Making

- About Us

- Careers

- Contact